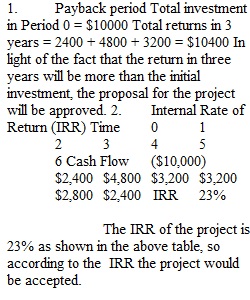

Q Assignment: Capital Budgeting Decisions Your company is considering undertaking a project to expand an existing product line. The required rate of return on the project is 8% and the maximum allowable payback period is 3 years. Time 0 1 2 3 4 5 6 Cash Flow $(10,000) $2,400 $4,800 $3,200 $3,200 $2,800 $2,400 Questions Evaluate the project using each of the following methods. For each method, should the project be accepted or rejected? Justify your answer based on the method used to evaluate the project’s cash flows.

View Related Questions